Discover how Creem Accounting Tools simplify your finances with automated tracking, easy invoicing, and reliable reports for small businesses. Managing finances can be tough for small business owners. With so many tasks to handle, finding the right accounting tool becomes crucial. One tool that stands out is Creem Accounting Tools. But does it help businesses simplify financial management? In this review, we’ll break down everything you need to know about Creem Accounting Tools, from features to pricing.

What Are Creem Accounting Tools?

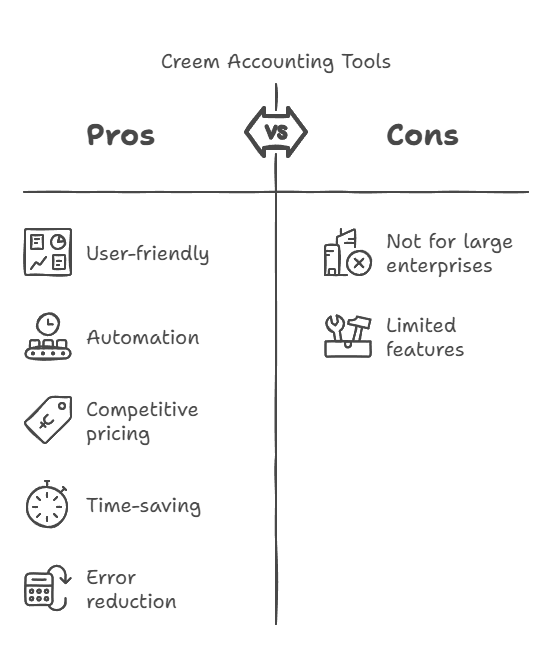

Creem Accounting Tools are designed to make business accounting easier. Whether you’re a freelancer, a small business, or a startup, this software helps you track income, expenses, and more. It aims to save time, reduce errors, and improve financial management. Creem Accounting Tools are a great choice for small businesses and freelancers looking to manage their finances easily. With its user-friendly interface, automation features, and competitive pricing, Creem helps you save time and reduce errors in your accounting. While it may not be ideal for large enterprises, it’s a reliable and affordable solution for small to mid-sized businesses.

Key Features of Creem Accounting Tools

1. User-Friendly Interface

Creem Accounting Tools offer a clean and easy-to-use interface. You don’t need a degree in finance to navigate the system. The layout is straightforward, making it ideal for people unfamiliar with accounting software.

2. Automatic Expense Tracking

Tracking business expenses can be a tedious task. Creem Accounting Tools lets you link your bank accounts and credit cards. This allows the software to automatically import and categorise expenses. You’ll always have an up-to-date overview of your financial health.

3. Invoice Generation

Businesses need to create and send invoices regularly. With Creem Accounting Tools, you can generate invoices in minutes. The system allows you to add your company logo, select payment terms, and send invoices directly to your clients.

4. Financial Reports

Creem Accounting Tools generate detailed financial reports that help you understand how your business is performing. You can access balance sheets, income statements, and cash flow reports with just a few clicks.

5. Tax Preparation

One of the most stressful parts of running a business is tax time. Creem Accounting Tools make it easier by organising your financial data. It helps you prepare taxes more efficiently and reduces the chances of mistakes.

6. Multi-Currency Support

If you’re doing business internationally, Creem Accounting Tools supports multiple currencies. You can invoice clients in different currencies and track your earnings easily.

7. Cloud-Based

Since Creem Accounting Tools are cloud-based, you can access your financial information from anywhere. Whether you’re at the office or working remotely, your data is available 24/7.

Get ‘ Creem’Official Website

How Creem Accounting Tools Work

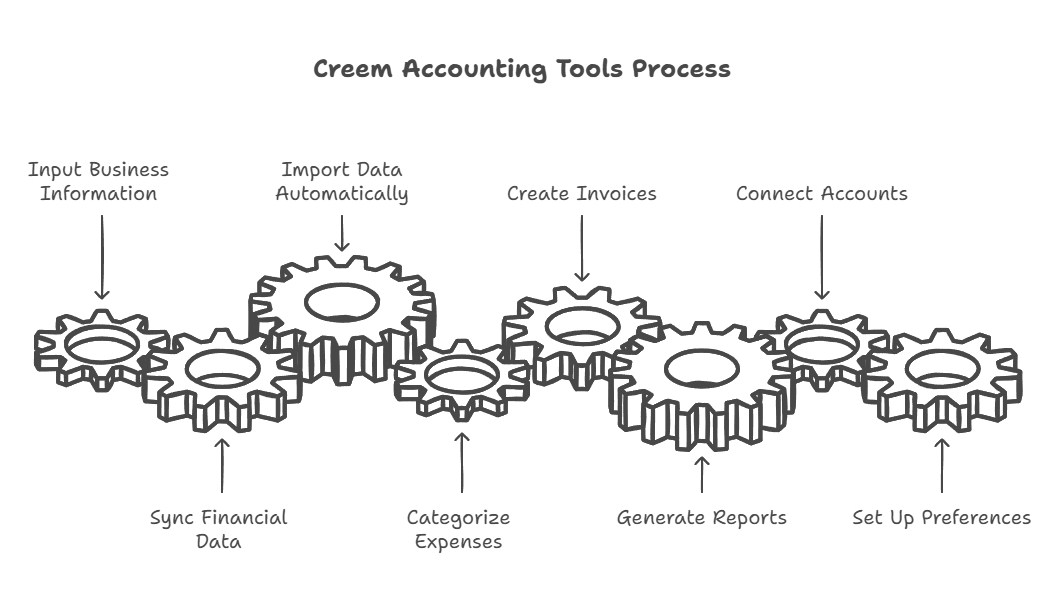

Creem Accounting Tools work by syncing all your financial data in one place. After you input your business information, the software starts importing data automatically. It categorises expenses, creates invoices, and generates reports.

For users new to accounting software, the process is easy to understand. You simply connect your accounts, set up your preferences, and let the software take care of the rest.

Creem Accounting Tools Pricing

Creem Accounting Tools offers several pricing plans. Each plan is designed to suit different business sizes and needs. Here’s a breakdown:

-

Basic Plan: Ideal for freelancers and small businesses. It includes essential features like invoicing, expense tracking, and basic reports.

-

Pro Plan: For growing businesses that need advanced features like tax preparation, financial reports, and multi-currency support.

-

Enterprise Plan: Designed for large organisations. This plan includes customised features, priority support, and additional integrations.

While pricing can vary depending on your location, Creem Accounting Tools offers competitive pricing. The best plan depends on the size of your business and the specific features you need.

Benefits of Using Creem Accounting Tools

1. Saves Time

Creem Accounting Tools automate many accounting processes, saving you hours every week. You no longer need to manually track expenses or create invoices. The software handles everything, allowing you to focus on growing your business.

2. Reduces Errors

Manual accounting can lead to mistakes, especially when dealing with complex data. Creem Accounting Tools reduce errors by automating calculations and categorising transactions.

3. Simplifies Tax Preparation

With organised financial records, tax preparation becomes much easier. Creem Accounting Tools help you stay compliant with tax regulations and ensure you don’t miss any deductions.

4. Provides Insights

Creem Accounting Tools generate detailed financial reports that offer valuable insights into your business’s performance. You’ll understand where your money is going and identify areas for improvement.

5. Improves Cash Flow Management

By keeping track of expenses and payments, Creem Accounting Tools helps you manage your cash flow. You’ll always know how much money is available for new investments or daily operations.

Who Should Use Creem Accounting Tools?

Creem Accounting Tools are perfect for:

-

Freelancers: It helps freelancers keep track of income and expenses and generate invoices.

-

Small Businesses: Businesses with up to 50 employees can benefit from Creem’s simple yet powerful features.

-

Startups: New businesses need a reliable, affordable accounting tool. Creem Accounting Tools offer an easy solution.

Even though large enterprises might find some features lacking, Creem Accounting Tools are a great choice for small to mid-sized businesses.

Creem Accounting Tools vs. Competitors

How does Creem stack up against other popular accounting tools? Let’s compare.

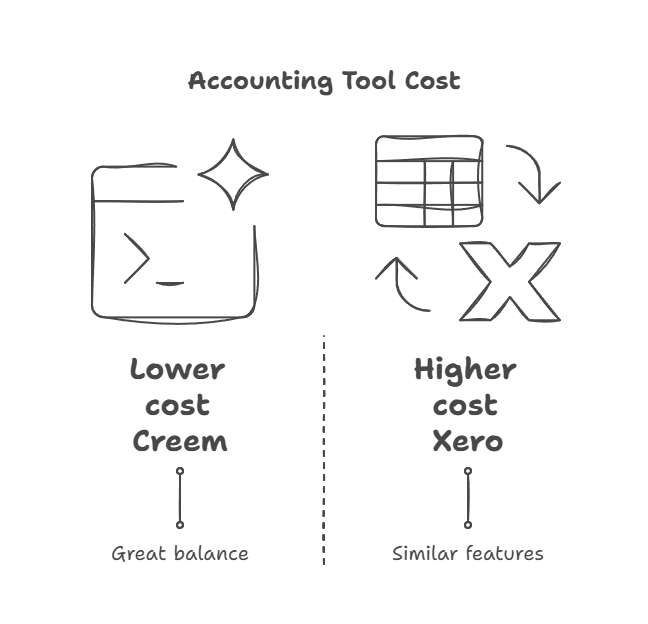

1. Xero: Xero offers similar features but is more expensive. Xero’s interface is not as simple as Creem’s, and it’s more suited for medium to large businesses.

2. QuickBooks: QuickBooks is another popular option, but it has a steeper learning curve compared to Creem Accounting Tools. It also costs more, making it less ideal for smaller businesses.

3. FreshBooks: FreshBooks is user-friendly like Creem, but it lacks some advanced features. If you need simple accounting and invoicing, FreshBooks may work better for you.

Overall, Creem Accounting Tools provide a great balance between simplicity and functionality. It’s an affordable option for small businesses that need core accounting features.

Customer Reviews of Creem Accounting Tools

John M. (Small Business Owner): “I’ve been using Creem Accounting Tools for six months. It’s been a game-changer for my business. The software is easy to use, and I no longer have to spend hours on accounting. Highly recommend!”

Sarah L. (Freelancer): “As a freelancer, Creem Accounting Tools are perfect for me. I can track my income and expenses with ease and send invoices directly to clients. It’s helped me stay organised.”

Frequently Asked Questions (FAQS)

1. What are Creem Accounting Tools?

Creem Accounting Tools are software that help businesses track expenses, create invoices, generate financial reports, and prepare taxes.

2. How much does Creem Accounting Tools cost?

Creem offers several pricing plans. The Basic Plan starts at a low price, while the Pro and Enterprise Plans offer more features at higher prices.

3. Can I use Creem Accounting Tools on my phone?

Yes, Creem Accounting Tools are cloud-based, so you can access them from any device with internet access, including your phone.

4. Does Creem Accounting Tools support multi-currency transactions?

Yes, Creem Accounting Tools supports multiple currencies, making it perfect for international businesses.

5. How secure is my financial data on Creem Accounting Tools?

Creem uses strong encryption methods to protect your data. Your financial information is stored securely in the cloud.