Simplify your finances with Dosh Personal Finance Tools. Track spending, set budgets, and save effortlessly with easy-to-use features. Start today! Managing your finances doesn’t have to be stressful or complicated. With Dosh personal finance tools, you can simplify how you handle your money. Whether you’re saving for a rainy day or managing everyday expenses, these tools help make financial tasks easier. This guide will help you understand how Dosh works and why it’s beneficial for your financial health.

What is Dosh?

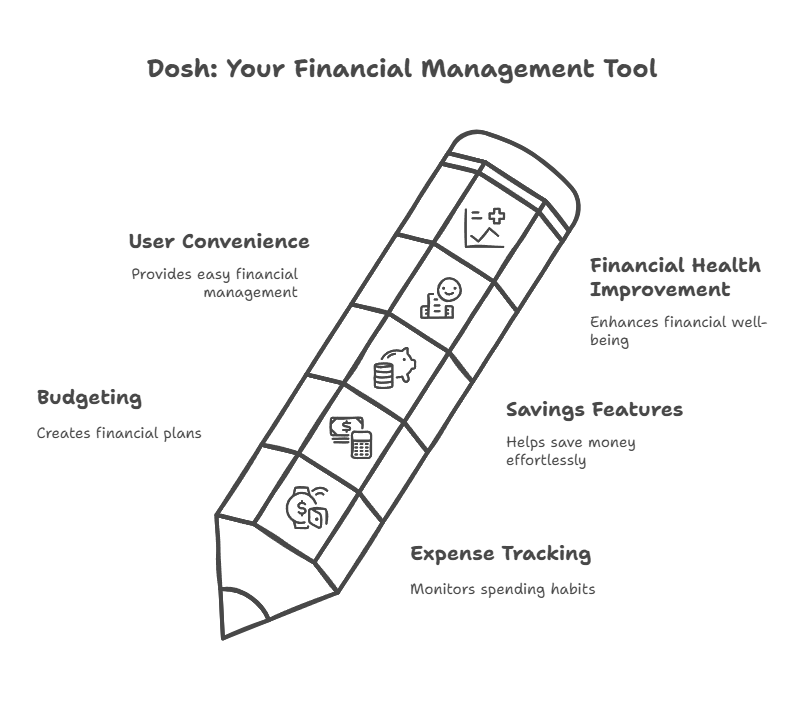

Dosh is a financial management platform that offers a variety of tools to help users track their spending, budget, and save money. The platform is designed for people who want to take control of their finances with ease. By using Dosh, you get access to tools that let you monitor your spending, create budgets, and find ways to save on everyday purchases.

According to a recent survey by Statista, 45% of U.S. adults used mobile banking apps in 2023, up from 37% in 2022. This shows the increasing reliance on financial tools to manage money in a convenient, accessible way. Personal finance tools like Dosh are gaining popularity as more people seek ways to better manage their finances and save money.

Dosh personal finance tools are an easy and effective way to take control of your finances. With its expense tracking, budgeting, and automatic savings features, Dosh helps you save money effortlessly. By setting goals and reviewing your spending regularly, you can improve your financial health and reduce stress. Give Dosh a try today, and see how it can simplify your money management.

Get ‘Dosh ‘Official Website

How Dosh Personal Finance Tools Work

Dosh personal finance tools work by connecting your bank accounts, credit cards, and debit cards to give you a clear overview of your financial situation. These tools help you monitor your spending habits, so you can make better financial decisions. Here’s how they work:

-

Tracking Expenses

Dosh automatically tracks every purchase you make, categorising it by type (e.g., food, entertainment, bills). This gives you a breakdown of where your money is going each month. -

Creating Budgets

With Dosh, you can set budgets for different categories. For example, you might set a monthly limit for eating out, entertainment, or transportation. Dosh will send you alerts if you’re nearing your budget limits, helping you stay on track. -

Finding Savings

Dosh helps you discover savings on everyday purchases. Whether you’re shopping online or in-store, the platform finds cashback offers and discounts for you. This helps you save money while spending on things you already buy. -

Setting Financial Goals

Dosh allows you to set specific financial goals, like saving for a vacation or building an emergency fund. You can track your progress toward these goals, keeping you motivated and focused on achieving them. -

Automatic Transfers

One of the key features of Dosh is its ability to set up automatic transfers. You can set up automatic savings transfers, which move a set amount of money from your checking account to a savings account. This helps you save effortlessly without thinking about it.

Benefits of Using Dosh Personal Finance Tools

There are several benefits to using Dosh’s personal finance tools. Here’s how they can help you improve your financial situation:

-

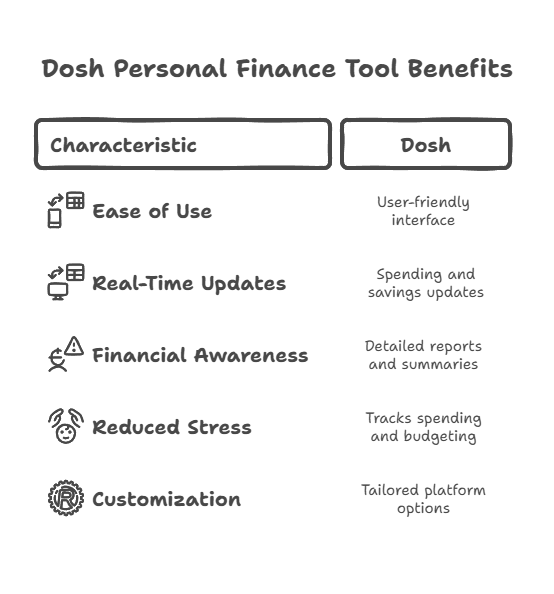

Ease of Use

Dosh is user-friendly, with an easy-to-navigate interface that helps you access all your financial information in one place. Whether you’re at home or on the go, the platform is simple to use. -

Real-Time Updates

Dosh provides real-time updates about your spending and savings. This means you can see your financial situation at a glance, which is essential for making informed decisions about your money. -

Improved Financial Awareness

With Dosh’s detailed reports and summaries, you’ll gain a better understanding of your spending habits. By seeing where your money is going, you can make more conscious choices about how you spend. -

Reduced Financial Stress

Dosh helps you avoid the stress of managing your finances. By tracking your spending, budgeting, and offering savings opportunities, Dosh makes it easier to stay on top of your finances and avoid overspending. -

Customization

Dosh personal finance tools offer customisation options that let you tailor the platform to your specific needs. Whether you’re a student, a family, or a small business owner, Dosh can help you manage your finances in a way that suits your lifestyle.

How Dosh Compares to Other Personal Finance Tools

There are many personal finance tools available, but Dosh stands out because of its ease of use and the variety of features it offers. Compared to other tools, Dosh provides:

-

Automatic savings transfers – Many finance apps require you to manually transfer money to savings, but Dosh automates this for you.

-

Cashback rewards – Dosh helps you save money through cashback offers, something many apps don’t provide.

-

Real-time updates – Unlike some other tools, Dosh gives you live updates on your spending and savings progress.

Tips for Making the Most of Dosh Personal Finance Tools

To get the most out of Dosh, here are a few tips:

-

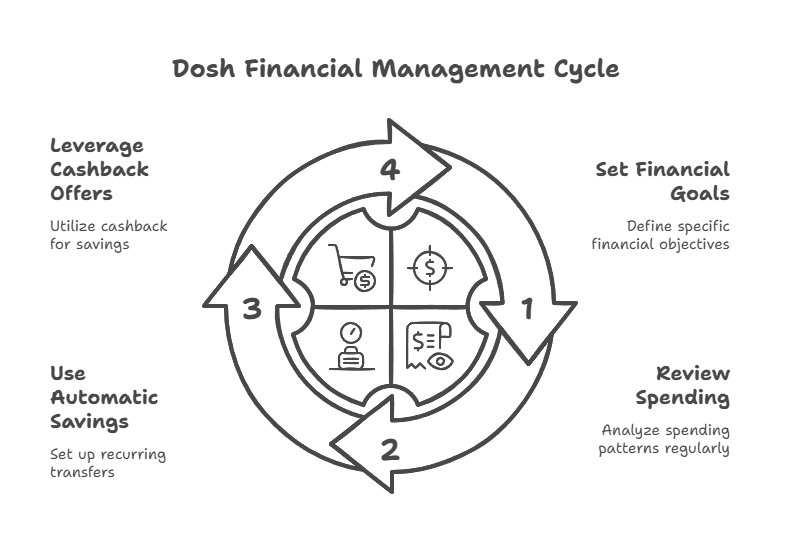

Set Clear Financial Goals

Before you start using Dosh, set specific financial goals. Whether it’s paying off debt, saving for a vacation, or building an emergency fund, having clear goals will help you use the tools more effectively. -

Regularly Review Your Spending

Make it a habit to review your spending on Dosh regularly. This will help you identify areas where you can cut back and save more. -

Use the Automatic Savings Feature

Set up automatic transfers to your savings account. This way, you save money without having to think about it. -

Take Advantage of Cashback Offers

Whenever you make a purchase, check for any cashback offers available through Dosh. This can add up over time, helping you save money on things you already buy.

FAQS About Dosh Personal Finance Tools

-

What is Dosh?

Dosh is a personal finance platform that helps users track spending, create budgets, and save money through cashback rewards. -

How do I set up Dosh?

Download the Dosh app, link your bank accounts or cards, and track your spending and savings. -

Can Dosh help me save for specific goals?

Yes! You can set financial goals in Dosh and track your progress, such as saving for a vacation or building an emergency fund. -

Is Dosh secure?

Yes. Dosh uses bank-level encryption to ensure the security of your financial data and transactions. -

How does Dosh provide cashback?

Dosh partners with various merchants and retailers to offer cashback on purchases. You can earn cashback on both online and in-store purchases.